What is Series A Funding?

Series A funding, also known as Series A financing or investment rounds for startups. The series starts with the seed round and continues with an “A” share of stock sold.

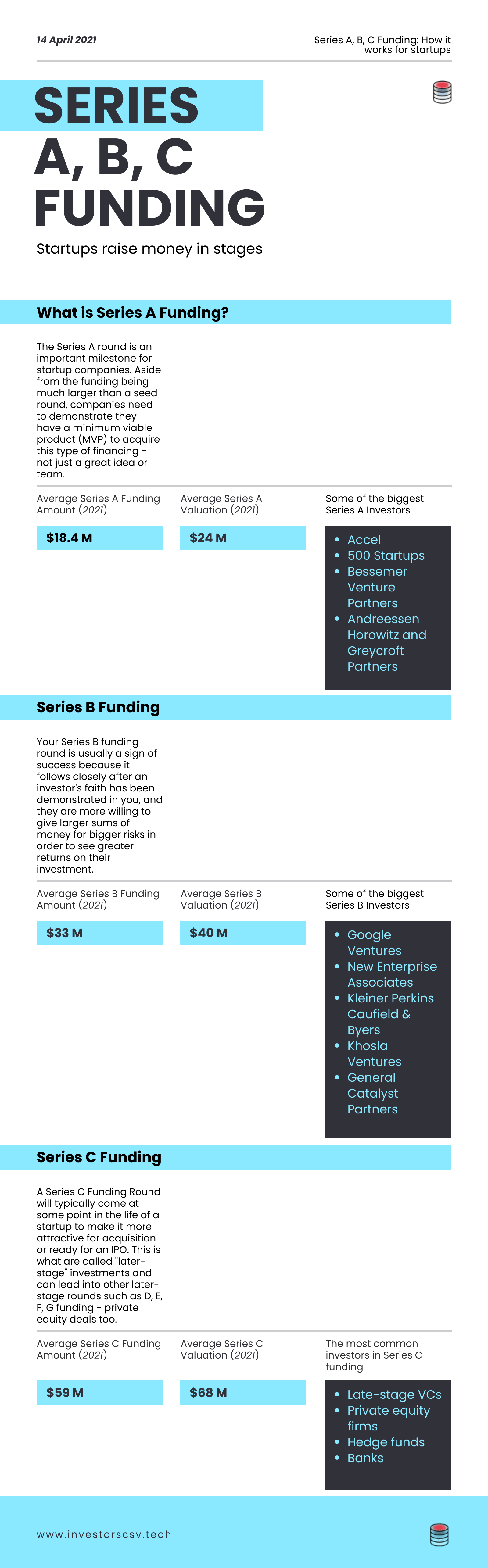

The Series A round is an important milestone for startup companies. Aside from the funding being much larger than a seed round, companies need to demonstrate they have a minimum viable product (MVP) to acquire this type of financing – not just a great idea or team. It’s hard for small teams with no products to successfully graduate into more robust types of financing like these; it takes more experience and proof that you can get your customers excited about what you’re doing in order succeed at acquiring capital through rounds such as these.

Receiving the first series A investment is an exciting time because startups are on their way towards building something huge if they prove themselves worthy during this stage and then reach reaching out beyond Silicon Valley investors who may be holding back.

Companies that raise a seed round are more likely to succeed when they go on to make a Series A investment. Raising capital can be difficult, but there’s no better opportunity than in the early stages of life for any company.

Different firms have different needs and desires with their investments- often times it is about how much risk each investor wants to take or if an individual has connections within your industry already; this makes raising money all the more challenging for new businesses as potential investors may not understand what you offer enough from just reading through some business basics online.

Series A Funding is the first round of funding that a company receives

The average Series A funding round has grown steadily over the years and is currently at around $18.4 million, of April 10th 2021. Investment activity ramped up significantly in Q1, 2021.

For example, for the week ending March 13th 2021 there were 23 Series A deals yielding over a half billion dollars in venture financing from VCs on that particular day alone – meaning more than 12% of all U.S-based startups are getting funded right now!

This trend towards increased investment comes as no surprise given such large rounds have been happening with increasing frequency: last year saw 72 investments worth >$50MM each (compared to 56 back in 2016), while 2018 had 47 companies raising an equivalent amount.

It is worth noting that the mean Series A has a significantly higher amount than the median Series A. In 2021, there was an early stage financing of around $8 million with Median in place for series and B rounds set at just over 8 M+. The significant disparity between means and medians exist because of “mega-rounds” occurring among biotech startups more often these days.

Series A Funding: Investors

In order to succeed in the competitive software industry investors from all over are investing their time and money into startups. Some of the biggest Series A Investors include Accel, 500 Startups, Bessemer Venture Partners, Andreessen Horowitz and Greycroft Partners just to name a few.

How to Get Series A Funding

Since series A funding is a pivotal point for any startup, it can be difficult to get without the right knowledge and connections. There are three simple steps that you should follow if you want to achieve this important milestone:

- Joining an accelerator program will help provide additional mentorship and resources;

- Leveraging your network of contacts (friends, family) who may have established relationships with investors or industries in which they operate could prove useful when seeking out venture capitalists;

- Finally extending your networks via online sites like LinkedIn to expand on these potential business partnerships from around the world.

It’s highly recommended that entrepreneurs plan ahead so as not only stay organized but also save time during their search for investment opportunities. So don’t hesitate – take action today!

The reason for this is that you are going to have more of a success rate with new meetings because they will be less inundated and won’t feel like your shoving them down their throat.

The point about nurturing relationships before pitching can help make the pitch process easier on both parties in the long run, so it’s worth investing time into these connections early-on without neglecting other parts of fundraising such as establishing a relationship with VCs who may not know what Aspect Ventures does but could offer valuable advice or introductions.

Series B Funding

A Series A funding is just to get the team and product developed. The next step for startups, a Series B Funding round, means taking it past the development stage. Venture Capitalist Tomasz Tunguz says that this one can be really challenging – especially since it’s more about business than anything else!

Your Series B funding round will be the gas that pushes your company to unprecedented heights.

Your Series B funding round is usually a sign of success because it follows closely after an investor’s faith has been demonstrated in you, and they are more willing to give larger sums of money for bigger risks in order to see greater returns on their investment.

Series B Funding: Average and Valuation

A Series B can be the make or break for your startup. $33M is a good amount to shoot for, and it’s not uncommon to see valuations of up to 40 million dollars in 2021.

Series B - Investors

The best Series B investors include Google Ventures, New Enterprise Associates, Kleiner Perkins Caufield & Byers and Khosla Venture Partners.

Series C Funding

A Series C Funding Round will typically come at some point in the life of a startup to make it more attractive for acquisition or ready for an IPO. This is what are called “later-stage” investments and can lead into other later-stage rounds such as D, E, F, G funding – private equity deals too.

Series C Funding: Average and Valuation

In the past month, there has been a substantial increase in Series C funding rounds that are nearing $60 million. The typical valuation for these startups is around $68 million pre-money and they hold an average of about 24% equity stake compared to other investors who often only take 10%.

Series C Funding: Investors

Series C funding is usually the last step in a company’s growth. The most common investors are late-stage VCs, private equity firms, hedge funds and banks which often invest alongside their portfolio companies as they try to grow into giants of industry.

Seed Funding

Seed funding is the first investment in a startup company. It comes from friends and family, Angel Investors, Crowdfunding or accelerators such as Y Combinator. The purpose of seed money is to see if there’s some product-market fit for your idea before you start looking into raising more capital later on.

When it comes to getting seed funding, networking and selling the dream are just as important. Seed funding ranges from tens of thousands of dollars up to $10 million for a 10%-25% equity stake in your company.

Seed Funding: Average and Valuation

How much funding do startups need? It depends! The average seed-funding amount is currently at $2.2 million, and the pre-money valuation of a startup receiving this type of money averages around $6 million.

Seed Funding: Investors

Accelerators like YCombinator and TechStars are major sources of seed investment for startups. Here is a listing of hundreds Angel Groups around the world, which provide some great opportunities to get in contact with potential investors. Seed Funding from large corporations such as Intel, Google or FedEx can help promising startups working on innovative technologies move forward at an accelerated pace.